As 2011 ends the decline of the “old world” continued with the UK falling to sixth place in the global GDP rankings, beaten this time by Brazil. Not only are they better than us at football they now beat us in the business world as well!

As we enter 2012 the dynamic forces that are shifting the global economy from USA/Europe/UK to the Far East/emerging economies will continue. The old world is mired in debt and the process of sorting this profligacy out will take many years yet leaving a growth gap into which the cash rich new world will gratefully move.

The political and social consequences of this transformation are impossible to predict, but this decade will for some be an economic boom time with forecasters predicting that by 2020 the top 6 economies will be ranked USA, China, Japan, Russia, India and Brazil. The UK will be fighting it out in the second division with thelikes of South Korea, Indonesia, Mexico and Turkey.

This change brings tremendous opportunities but also risks as such changes are unlikely to be smooth. As investors though, weneed to balance these risks against the potential reward. There are no certainties in the investment world but what is clear is that this change in leadership is happening and it is accelerating. These economies are starting to by-pass the west and trade between themselves; they are now reaching a critical mass which means they are not dependent on selling cheap consumer goods to fund their growth. So in investment terms we can be confident that this process is robust.

If we can tolerate the volatility we know wewill be buying into the future global leaders.

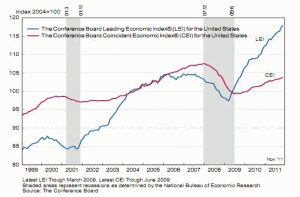

The "Normal" Cycle

The second half of 2011 has threatened to break the trend as the euro debt crisis has raged, but in terms of a switch from equities to bonds the case is not as yet clear cut. We have talked before of a five year cycle that favours equities, it can be distorted but this one started on March 2009 so in theory there is still plenty of time left for equities to deliver growth.

Especially as in recent newsletters we have highlighted how low equity valuations are whilst bonds are very expensive. We also have the US Presidential cycle, election in 2012 new/same old President in 2013, US recessions occur early in a Presidency (for obvious reasons) tying in with the above 5 year cycle.

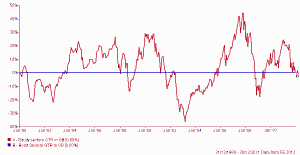

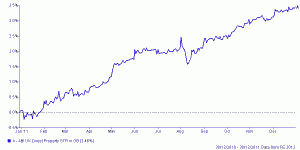

Gilts

2011 was the year of the tortoise with Gilts delivering positive returns. In the UK we are as indebted as Italy but we have a plan, we also have QE which floods the banking system with cash and we can let the currency fall thus deflating the relative size of our debts.

As a trader buying Gilts is an easy option as the Bank of England is forcing up prices (QE), thus you buy knowing there is a sugar daddy behind you to bail you out. As investors though we always have to ask ourselves “what if?” Italy yields about 6.9%, Gilts yield about 2.5% (below inflation).

Could confidence in Cameron/Osborne erode to the extent that the UK’s ability to fund its debt comes into question? Market confidence is a very fragile thing, lose it and Gilt yields could easily rise closer to Italy’s.

There is no sign of this happening but a combination of deep recession, no money left for QE and perhaps an election might cause such a scenario to occur? Unlikely, but better to be aware of what the risk may be.

Gilts and Index Linked Gilts

Corporate, International and High Yield Bonds

Past Performance is not a reliable indicator of future results.

Bonds

This sector covers a wide range of assets including overseas government debt and corporate bonds. Generally speaking bonds did okay in 2011 with defensive International bonds and high rated corporate bonds the best. Large multinational businesses are flush with cash and are perceived to be safer than many countries.

Any country at risk of having their credit rating downgraded was punished in 2011 especially in Europe where the constraints of a single currency but multiple governments created a mess that has yet to be resolved.

As the ratings of the USA and European countries went down, up went the ratings of the Far East and other emerging markets, mirroring the economic conditions. The more volatile High Yield Bond sector now includes much bank debt as well as lower rated industrial businesses. The latter will be fine as long as recession is avoided. Banks though remain very hard to call.

Banks

The banks remain the “villain in the piece”. Banks are needed to facilitate economic growth but they can’t lend if they haven’t got access to short term cash. The 2008 Credit Crunch closed the short term cash market down, it still being kept open only with help from Central Banks. Bankruptcy was averted only by direct hand-outs from Governments. It is now payback time.

Those Governments are now closing the stable door after the horse has bolted. Globally banks are being told to split retail and investment banking. This means they can no longer use Joe public’s cash to fund trading on markets. Secondly they have to have more cash on their balance sheet, which means less to lend. Throw in many European Banks assets (EU government debt) are falling in value then the risk of another Credit Crunch increases. Also US litigation is rising with Citibank in court for fraud, they won’t be the last.

Those of us who are old enough to remember the Latin American debt crisis also remember the regular capital raising through rights issues undertaken by all the clearing Banks through the 1980 and 90s.

This should be a theme for 2012, fund raising and mergers forced or otherwise within the banking system. Barclays for example may split its’ businesses or even sell its UK retail business, HSBC may see its UK business as increasingly irrelevant and do the same.

France may reorganise its banks as a defensive measure etc. Retail banks if free from dodgy debts may start lending again but it’s anyone’s guess of how these changes will pan out. Banks are a necessary evil, Governments want revenge but they also want economic growth and the balance between the two will be very hard to achieve. Also, who will provide the much needed new capital? The western governments can’t afford it?

We would expect the Global banking sector to look very different at the end of 2012 than it does now. Bashing the banks is a potential vote winner.

Equities

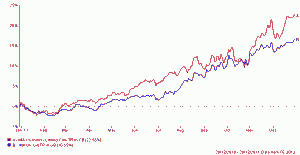

UK Equities and Global Equities

Far East and Emerging Market Equities

Past Performance is not a reliable indicator of future results.

What can be seen from these charts is that there is no difference in the shape of the charts. Equities are equities regardless of where they are domiciled and this is reflected in the performance of the sectors with currency the main variable. We have to stop thinking of UK versus USA; these are multinational businesses that are interwoven into the Global economy.

The UK stock market is as much dependent on the Chinese economy as the UK! The likes of HSBC, Standard Chartered and the mining and oil sectors are all reliant on a booming China.

The high growth markets are always the more volatile, just as are high growth companies. So in falling markets we should expect the growth economies or growth companies (such as mid-cap companies) to do worse, conversely they will do better in rising markets.

The themes for 2012 are the same as 2011. Will China start to reflate? Will the US economy continue picking up? Will Europe spark a new credit crunch and thus a new recession? As we have said before China is the key, China reflates then it also bails out the US and helps Europe.

The overall background for equities is very positive, loose monetary policy, a Presidential election in the US, a change of Premiership in China, high levels of profit growth and very low valuations. But fear of another credit crunch and concern that growth is not quite as good as it should be is holding back prices. It is as though markets have priced in a recession for 2012?

As we said before no sign of a recession as yet, indeed the Chinese are beginning to ease (already announced reduction in Bank capital requirements) the markets could realise they have been too pessimistic. If so equity prices will have to rise.

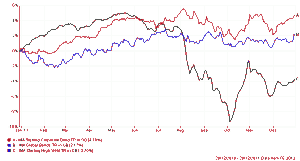

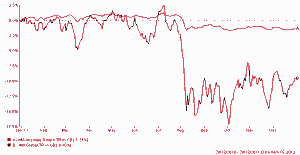

Property/Absolute Return

Property

Absolute Return compared to Global Equities

Past Performance is not a reliable indicator of future results.

Both these sectors have proved to be defensive in a difficult year. Property is the more surprising and is not based on a healthy market. Apart from West End London “trophy” sites where the global super rich are investing spare cash most UK property sectors remain moribund.

What we are seeing are surveyors revisiting very pessimistic valuations from 2008 hence the increase in unit prices as well as retained rental income within the fund. For Property to boom again we need a healthy banking sector, which we

haven’t got.

The small but evolving Absolute Return sector did okay beating equities but underperforming bonds. There are a wide range of strategies used and the sector numbers are not that representative. Given the opacity of the economic outlook we expect another theme of 2012 will be the rapid development of this sector and the underlying strategies used.

The big Hedge Funds faced with new legislation are moving in from the fringes of the investment world and will become more main stream.

Gold

Gold unit trusts invest in mining shares not bullion and these prices fell as China deliberately deflated. Also as investors ran for cover they bought US Treasuries and thus the Dollar. Gold as the hedge for Dollar weakness was sold as well. If recession is averted and growth picks up then so will fear of inflation.

Gold far from being an alternative to equities is now being driven by the same forces.

Investment Strategy

So what to do in 2012? This is not an easy question to answer, assets that are expensive (Bonds) are going up in value and assets that are cheap (Equities) are going down. Value will always win out, but we don’t know when. Whilst the European soap opera keeps plodding on and thus the risk of another credit crunch/recession remains elevated investors will remain on the back foot and will play a defensive game.

Furthermore Iran remains unfinished business for the USA and is on our watch list. Wouldn’t be the first time a US President has chosen a military option as a vote winner.

So there are many headwinds facing markets in 2012 but we mustn’t overlook the positives, the cycle should be our favour, valuations are cheap, interest rates are low and will stay low and China is starting to reflate. Obama is desperate to be re-elected and will do what he can to get the US booming ahead of the vote. So if we can get over the European issues we have a reasonable chance for healthy equity markets. It is however a big if. The best way to make money in the markets is be a contrarian, to buy what is out of favour and wait for value to be realised. That is the key as long as you have time to wait; the equity markets will always pay back your patience.

The early part of 2012 may require that patience!

As always though experience suggests that an investment year rarely pans out as expected and as such we will continue to monitor markets and act accordingly.

December 2011

Click Here for Printable Version