We have written in previous Market Views about the battle between the Inflationists and the Deflationists. Rising inflation and global economic growth forced the latter camp back into hiding but a combination of slowing old world economies, the threat of a European Credit Crunch, political infighting and the normally quiet Summer months has brought them out of the shadows again. All of these factors together with impact of computer based share trading programmes have caused markets to fall in value.

So what has actually happened? At this stage of the cycle US economic growth should be accelerating, it isn’t. This is a topic we have discussed at length before, but the penny finally dropped that with China throttling back the US has lost its crutch and is struggling with stagnant house prices and high unemployment. This stopped the buyers in their tracks just after the QE2 hot money had left. On top of this it was August, the quietest month of the year when decision makers are in holiday mode. The US debt downgrade was a non-event but the political argument simply highlighted how few options Obama has to stimulate the US economy.

When key support of the 200 day moving average gave way the computers kicked in. Acting on auto pilot these High Frequency Trading programmes simply followed the trend down causing a self-fulfilling stampede of selling, remember this was in a holiday influenced quiet market with few traditional buyers around to take up the slack. If we then add into the mix the continuation of the European Sovereign debt soap opera it’s hardly surprising the markets fell after holding up so well for so long.

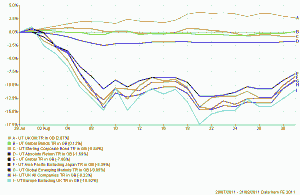

Unit Trust Sector Performance August

has been in Europe otherwise equity markets fell roughly in-line with one another, confirming that equities are a truly global market with national boundaries increasingly irrelevant.Absolute Return did its job and despite the threat of new European credit crunch Corporate Bonds held up well (at the lower risk end). So for a balanced portfolio August has been a painful month but not a disastrous one. However, bonds are fundamentally expensive whilst equities are fundamentally cheap thus we have to beware of the trap that comes when we chase performance rather than value.

Overall though not much has changed; we are still waiting for the US economy to pick up or for China to reaccelerate. Recent statistics from the US have been mixed with job growth, critical for both the Fed and Obama, falling to nothing. Corporate earnings remain healthy with the likes of Wal-Mart doing surprisingly well given the supposed weakness of the US consumer. The market is now assuming growth will drop by nearly 2% but this at the moment is literally a guess.

Markets are notorious for predicting recessions, a famous market phrase is they have predicted nine out of the last three recessions. As we saw last month we are still in the early part of the five year growth cycle so the balance of probabilities is that this is merely a crisis of confidence for the markets, particularly as post credit crunch recoveries are often anaemic and volatile. As we write there is limited hard evidence that we are double-dipping.

What would cause us to double-dip? China slowing further? This would appear unlikely with Chinese inflation under control and the next move likely to be some economic easing. European Credit Crunch? This is a big risk; the PIIGS crisis has reached Italy and Spain, and is starting to touch France. These countries have international banks such as Santander (which bought Abbey National)and are knitted into the global financial system; a collapse of any one of these will have severe consequences for the system. Philosophically this shouldn’t be a “Lehman moment” as the US was morally against nationalisation, Spain, France and Italy will (if they can afford it) bail these banks out. We have been here before and we know the solution. But the issue in Europe is political and constitutional. Nothing happens quickly in Europe yet the markets are impatient and they will force the point,it will be volatile.

Bernanke and Obama meanwhile areseeking to reflate the US; this might be with QE3, or maybe with something else? The September FOMC meeting has been extended which also gives the Fed more decision making time to assess whether the recession risk is real. Obama has proposed $450 billion worth of job creating measures equivalent to a 3% addition to US GDP, if he can get these measures through Congress then this will be a massive boost to the US.

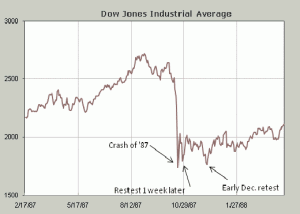

The 1987 Crash

These are the after effects of the Credit Crunch hurricane. Private bank debt was transferred to governments and there has not been enough growth in those economies to reduce the debt percentage to healthier levels, a copy of Japan. Just like Japan though the underlying companies are healthy and cheap, if they can’t sell their wares to the US consumer they will sell them to the Chinese instead. The slowdown in the US economy could be more to do with China’s battle against inflation as much as high domestic unemployment? The Chinese are famous for taking the long view, maybe the biggest risk of all is that they sacrifice short term gain to“dig the knife” into the USA in a bid the achieving Global number one status? September will be another tricky month particularly for Europe as Italy seeks to roll over billions in debt and the German Constitutional Court could yet scupper any plans for saving the Euro. But look who is back buying? Just as in 1987 when he invested in Salomon Bros and 2008 with Goldman Sachs, the world’s greatest investor Warren Buffet has just invested billions into Bank of America. That is how he became so successful, buy cheap assets when no-one else wants them.

August 2011

Click Here for Printable Version