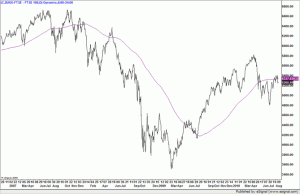

In markets terms the summer doldrums have continued, the battle between optimistic inflationists and the doomster deflationists has continued. Each keeps landing sharp jabs but no knockout blows. As a brief recap the inflationists are looking for a normal economic recovery and a new Bull market will climb “the wall of fear and worry”, bailed out by China the old world of the West will return to economic normality.

The Pessimists claim that we are entering a long term Japan style depression. This, they say, will be caused by bankrupt banks refusing to lend and equally bankrupt governments draining spare cash and demand from their economies to pay down huge debts. What is marked is who is actually in these camps the old stock markets “lags” such as Warren Buffet and Anthony Bolton are in the optimistic group, whereas the doomsters are mainly economists and fixed income fund managers.

It is our contention that nobody really knows, they are all “talking their own book” and as investors we must be pragmatic, monitor the news and act accordingly. Let’s look at what news the last few weeks has given us.

Corporate News

What caused the market to rally back to this key trend line has been corporate news. Ultimately share prices are determined by company profits everything else is just noise. Company after company from banks to technology stocks all came out with profit figures that matched or beat expectations, and this is the key as the market is priced not on current profits but on next years. Beating the expectations which have been priced into a stock’s share price creates a new higher earnings base to grow from and also a higher rate of growth as well, so up it goes.

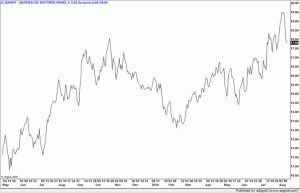

Perhaps the most startling results and one that encapsulates the optimist’s view of the world have been the results from luxury car makers such as BMW, Audi, Mercedes and even Jaguar/Land Rover.

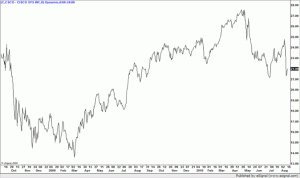

So what we have again is some recovery in the Old World with dramatic growth in the New World. What is becoming apparent however is for this bail-out to continue then emerging market growth must be increasingly self-generated; so far this is the case.

The majority of recent growth has come from trading between the various constituent countries; in the last 10 years inter-emerging market trade has risen from 10% of Global Consumption to 30%, a total now equal to that of the USA. This is despite China trying to slow down its rate of growth. China has now officially become the world’s second largest economy by overtaking Japan. There are now four Chinese Companies in the World Top Ten, yet many investors treat China as a high risk peripheral area!

Economic News

Recent economic news has been very much a mixed picture with something for everyone in the numbers. German GDP figures, like their football team did better than expected, helped by the likes of BMW, though they have lost their trophy of the world’s largest exporting country to, yes of course China. However, in absolute terms German exports have returned to pre-crisis levels, an amazing achievement.

The UK continues to lag; perhaps the key remains the housing market? Despite their protestations to the contrary Banks are still not lending. High deposits of 15% plus, high actual interest rates and also very expensive arrangement fees of circa 2% make mortgage borrowing extremely expensive at a time when the media is full of gloom about house prices. This is a “chicken and egg” situation, the banks won’t relax their lending criteria until they have the safety net that rising house prices provide, yet the house buyer won’t buy until finance costs come down. This is what Governments are for to intervene in just these circumstances, however this is unlikely.

The US is also struggling to recover, unemployment continues to rise; critical given the Federal Reserve Bank has a full employment mandate as well as low inflation. The US consumer will not spend if there is an unemployment risk. Just as in the UK, the US civil service is under job threat for the first time. This is not from Central Government but from a financing crisis at the individual State level. So with no consumer growth likely until unemployment falls, the US economy needs business to spend instead. This is why the news from IBM and Cisco could be so significant.

The response so far has been some further Quantative Easing as well as the passing of a new Jobs Bill. This will not be enough but it does send a clear signal to the markets that the Fed and the US government are still looking to spend their way back to normal growth. This for both share prices and stock markets globally should be good news.

So on balance still a stalemate between the two camps but as summer comes to an end, we must watch carefully for a decisive move in either direction.

August 2010.