As the long wet summer finally comes to an end so should the market doldrums. Those that “sold in May” will be shortly returning to their desks, though to complete the adage won’t be doing anything until after the St Leger.

Traders will look at the markets and find that since they have been away Bonds are up and Equities are flat to down. Though to be fair May does account for most of equity underperformance, if they had chosen to “go away” at the end of the May rather than the beginning then equities would be up nicely, this was despite the continuing European sovereign debt drama.

But the quiet times are coming to an end. We have just had the Annual Central Bankers Conference at Jackson Hole, now we have a key ECB meeting on Thursday the 6th September followed by a German Court decision on the legal status of the ESM rescue fund on the 12th September, the same day as the Fed’s FOMC meeting (and also the first day of the St Leger races!).

Any of these events has the potential to ignite the markets. What is new though is the performance of the UK economy which if anything has deteriorated further over the summer despite or maybe because of the Olympics.

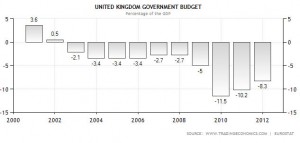

UK Government “Overdraft”

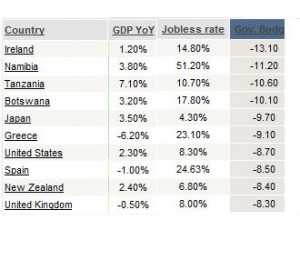

If we ignore the African countries we are in some pretty dodgy company! What is the difference between the UK, Spain and Greece?

The answer, apart from they have better weather, is that we can buy our own government debt to force yields down and stave off a crisis. Also we have a plan and as such Cameron/Osborne have the confidence of the markets. But confidence is a fickle thing, it can rapidly disappear.

Markets will tolerate a high overdraft only as long as the economy is growing; no-one worries about the US deficit (yet) because the economy is still growing, and thus so are tax receipts. When there isn’t any growth, tax receipts fall and the deficit doesn’t come down, then there is a problem and the confidence could evaporate.

Recent UK data is worrying as it is showing that the above is now a real risk as the deficit is starting to rise again and so far there is no Plan B. Markets are however still giving the UK the benefit of the doubt and cash continues to flow into Gilts as a safe haven. But what would happen if Europe started to sort itself out? The money would rapidly move into high yielding Italian and Spanish bonds and Gilts would be friendless.

So we could have no growth, a huge government deficit, market sellers of Gilts and the Bank of England rapidly printing money to buy Gilts off these now willing sellers in a desperate attempt to keep the yields down. That would be a mess of Olympic proportions. We need growth and soon, the problem is how? The finances are so poor George Osborne can’t cut taxes to boost consumer spending, nor can he afford to invest in infrastructure projects like the Chinese.

He has to do something though and seems to be looking at easing the planning process to get developers building again. Also the Treasury and Bank of England are still trying to find ways to get the banks’ lending.

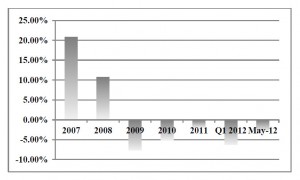

Growth in UK Bank Lending

We cannot have growth in the economy without bank lending, the two go together, and something needs to be done to kick start these numbers, only once this happens can we return to normal levels of growth.

Jackson Hole

Markets keep hoping for another round of Quantative Easing (QE) from the US Federal Reserve Bank. Recent statements have left the door open for this but there have been few signs that it is imminent. The Fed traditionally does not act during a Presidential Election so as not to be seen to be political, so if it is going to happen it has to be soon.

Every year the Fed Chairman hosts a conference of international central bankers and makes a keynote speech. Hopes weren’t high that he would announce QE at this event and he didn’t. But he also didn’t rule it out, and the language appears to suggest that it might be a possibility. Expectations are now that something will be announced at the Fed’s interest rate meeting on September the 12th.

Interestingly, Gold prices (a big beneficiary of QE) have started to rise; maybe somebody out there knows something?

Markets

September is usually a very active month; we get a raft of corporate results and also an increase in political rhetoric as the politicians go back to work. This September though brings with it two key dates, the first is on Thursday the 6th September when the ECB starts to flesh out its plans for bringing down the cost of Italian and Spanish Government debt. This should be through a bond buying programme.

There will be issues, however, about the legality of such a programme and also the scope of it. So far the Europeans have done the bare minimum they need to do in order to “kick the can” down the road, odds are they will do the same with the bond buying programme but there is always the possibility that they might go further.

We then have the Fed on the 12th and on the same day a ruling by the German Constitutional Court on the legality of the European Stability Mechanism.

So for markets it could go either way depending on what comes out of these meetings. If we get QE and the ECB succeeds in bringing Italian and Spanish Bond yields down then this will be healthy background for continued strength in equity prices.

George Osborne meanwhile will be hoping that American and Chinese growth accelerates which would help UK exporters and give us a bit of their growth, which realistically is perhaps all that he can hope for at the moment.

August 2012

Click Here for Printable Version