April has seen global markets pull back as politics impacted on sentiment; this was despite a very healthy set of US company results. The French Presidential Election first vote saw swings to both the right wing and the left wing putting Sarkozy’s future as President in doubt. The French public are voting against austerity and German interference. At the same time the Netherlands ruling coalition fell apart. This led to fears that the stability pact wouldn’t be implemented and as Spanish and Italian bonds fell in value so did equity markets.

The US earnings results season went according plan but as we highlighted last month Apple’s shares did break trend and fell in value. As the USA’s largest stock, markets couldn’t rally whilst Apple was out of favour. However, when Apple’s results were finally announced they were yet again spectacularly good. Profits were up by 93% on this time last year; with 18% of its market value in cash, Apple shares valued on a market rating are very cheap. This is what should keep equity markets rising, shares are simply too cheap and whilst European politics are unnerving the underlying value is there to support markets.

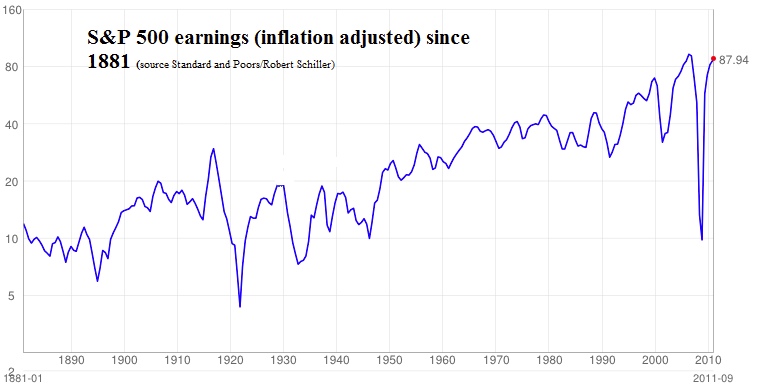

Company Profits

Despite all of the worries over Europe and another possible Credit Crunch this chart shows the key driver behind rising global share prices. This is the actual profits of the S&P 500 constituent companies indexed on an inflation adjusted basis since 1881. As company profits rise so must share prices. The 2008 Credit Crunch saw earnings fall of a cliff as banks made huge losses and companies ran for cover as the consumer suddenly stopped spending. The recovery though has been very powerful for profits and forecasts are for S&P 500 earnings to reach $100 a 13.5% increase over the next 12 months. This is a major support for equity prices.

What is confusing for many is that with austerity and no/low growth, particularly in Europe, how can company profits be so good? Well as we have said before it is the dramatic growth of the new economies particularly in the Far East which is bailing out the old ones. Looking forward, for company profits to continue growing and for equity markets to be well supported we need one or preferably two things to occur. Firstly, China doesn’t slow down too much and/or the western consumers start spending again. What do we need for the latter to happen?

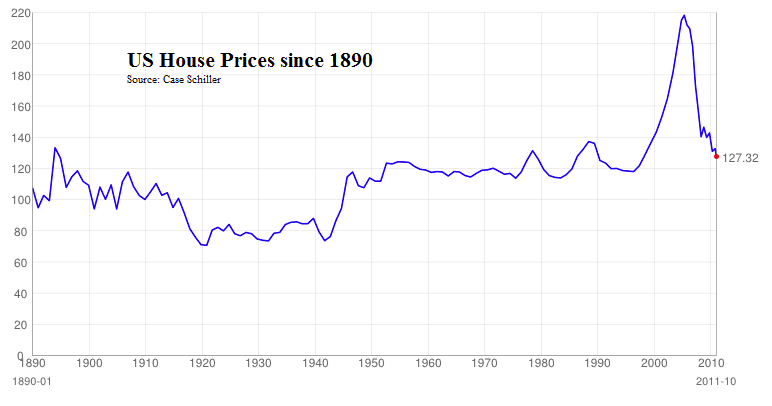

Housing

Both the USA and the UK have a dynamic tradition of home ownership which is far less common in Europe; historically economic booms have been accompanied or indeed created by an equivalent housing boom. The Credit Crunch created an oversupply of housing in the USA and scared off buyers as prices fell. In the UK valuations also fell but so did the number of transactions. Banks have no cash to lend and where they have cash they are being very strict. A mortgage in the UK is now difficult to get, expensive with high arrangement fees and also demanding a higher contribution from borrower. Banks are being cautious and they need the comfort blanket of rising house prices to encourage them to lend again. It will happen, just a question of when?

We suspect the lead once again will come from the USA. Whilst US house price indices are still falling, the rate at which they are falling is slowing down. As the volume of home sales continues to recover, prices should find increasing support. Whilst it is progressing very slowly, sales in the first quarter were 5% higher than a year ago. However there has been an important shift in the composition of these sales. “Healthy” sales (not counting foreclosures and short sales) have improved 17% compared to a year ago.

This should help prices in many US cities find a bottom in the coming months. It is still very early days but UK Banks will watch very closely what is happening in the USA and if unemployment also starts to fall they may consider removing some of their self-imposed lending restrictions.

What happened next caused the Credit Crunch in 2008. Prices collapsed making the packaged Mortgage Bonds worthless putting the whole financial system under threat. This is now working its way out, whilst prices are back to the long term average, which is encouraging.

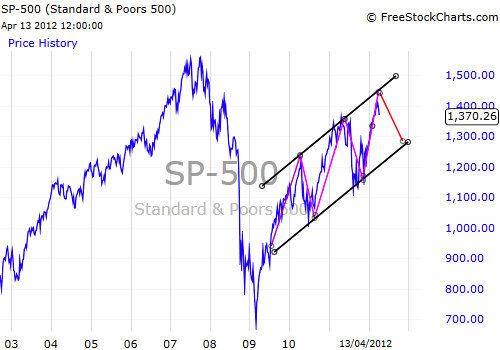

Markets

As we enter May we have no doubt that the media will begin to talk about “Sell in May”. The true adage is “sell in May go away and don’t come back until St Leger Day” and was perhaps more to do with managing cash for the formal English Summer Season of sport and Balls. Clearly news flow from governments and companies does slow during the summer and most market “bets” are placed in the first quarter of the year, hence reduced trading activity. Bull markets “Zig and Zag” their way upwards, more formally this is known as “Volatility”. For investment managers we have to be careful not be “suckered” out of good long term growth positions by short term market movements.

Before Apple’s results the European political situation had returned to haunt the markets. Hollande does look to be the next French President but is unlikely to rock the boat too much, similarly neither will a new Dutch coalition. But this could be among the first of many European hurdles that the markets must face over the summer. The European “consensus” approach infuriates markets which are more used to decisive Anglo-Saxon politics.

The Chinese leadership transition is also in the background. France may make more headlines but it is China that supports the markets. Any slowdown in Chinese growth and any political impasse that may exacerbate it would have an immediate impact on corporate earnings and thus share prices. No sign at all that this may be happening so again China trumps Europe and corporate earnings trumps them all.

March 2012

Click Here for Printable Version