Click Here for Printable Version

Normally the Summer months are quiet ones for the global markets, not so this year. Donald Trump’s trade tariffs were finally implemented and US consumers have just started to see the impact on prices. How this develops over the next few months will have a major impact on the new Bull market. Theoretically, this can’t be good. Trump needs interest rates to go down to counteract the one off jump in US consumer prices expected in the run-up to the crucial Thanksgiving spending period. It seems that he might just get his way. Many forward-looking surveys were indicating that the US economy was weakening, yet the official numbers, particularly jobs growth, painted a more positive picture. The August jobs data, however, was poor and crucially revised down prior numbers, thus at a stroke confirming the surveys and supporting an immediate interest rate cut. An incensed Trump promptly sacked the head of the Bureau of Labour Statistics. Prior to these revisions the bond markets thought a cut in US interest rates was unlikely for the rest of 2025. They are now pricing in 3 cuts! For markets this is just fine, interest rates down markets up. Short term the inflation risk remains, a one off jump to 4%-5% inflation is expected, more and a prolonged period of high numbers would threaten markets. The markets can survive the short term tariff headwinds as long as the AI boom keeps going. Cuts in interest rates would be very helpful as well.

Money Supply

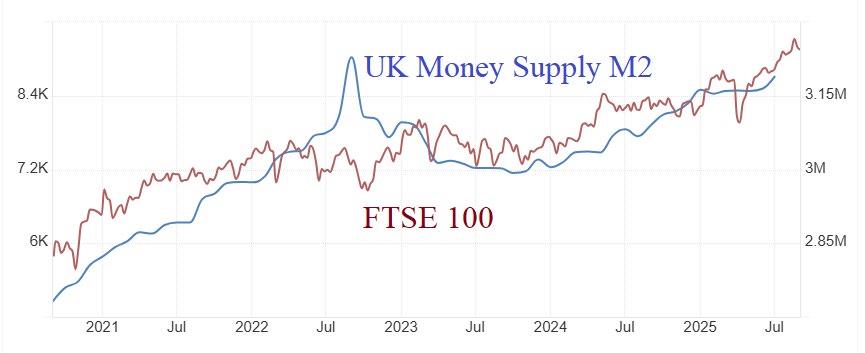

If the rate of change of prices (inflation) accelerates, central banks seek to “choke” the economy to slow down growth and even turn it negative (recession). Ostensibly this is done through the official interest rate e.g. UK Base rate. But interest rates are just part of a broad strategy such as Quantitative Easing/Tightening and controls on commercial bank lending all of which make up the Money Supply. There are various measures of Money Supply, these charts show M2 for the UK and USA. Simply, if the Money Supply goes up so does the stock market and vice versa. As these charts show the Money Supply has been increasing since November 2023 and thus, so have the stock markets. Importantly, the Fed Chairman Jay Powell stated in a recent keynote speech at the annual Jackson Hole symposium…“with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” That in typically vague “Fed-speak” suggests there is more Money Supply coming to the US economy and thus for markets, there is still much further to go

UK Economic Policy

The UK’s next Budget is planned for the 26th November 2025, just in time for Christmas. It’s pretty clear from the wide ranging media briefing that is currently underway this is not going to be a good one, not for taxpayers or for the economy. There have also been widespread personnel changes both in Number 10 and 11 Downing St. There is a common feature on the CVs of these new and promoted advisors, all have worked for the Resolution Foundation, “an independent think-tank focused on improving the living standards for those on low to middle incomes”. Many of the policies already announced around Inheritance Tax on pensions, farmland, and businesses are all straight from the Resolution Foundation’s published research. So in order to plan for what might be coming in the Autumn Statement we need to look at what other tax measures they have proposed in the past? Helpfully, despite Labour MPs calling for a Wealth Tax, in a very recent document the Foundation stated that “recent calls for a recurring wealth tax… In economic terms, taxing the same wealth every year would penalise saving and investment. Principled arguments aside, the valuation of individuals’ wealth necessary for such a tax would require a colossal bureaucratic effort, hardly a realistic prospect for quick revenue.” That, however, doesn’t mean that other existing wealth taxes will be spared. Aligning Capital Gains Tax rates with Income tax and treating property gains as income have been mentioned in a number of policy documents. Another floated idea is to add new Council Tax Bands for “mansions” with higher rates applied to these properties. Would again involve complex valuations taking place and the money, in theory, would go to Local Authorities not Central Government. A more radical idea floated by Resolution staffers in the past was to scrap employee National Insurance and fold it into Income Tax, thus, those that don’t work but are taxable e.g. retirees, would pay more tax. Whilst the wealth tax as demanded by many Labour MPs might be party politically desirable it would be difficult to implement and that means it seems more likely that all the other existing wealth taxes e.g. Inheritance, Capital Gains, Property and Council could be squeezed to the maximum. Critically, this is not just a cash raising exercise, these would primarily be political social policy moves seen as redistributing wealth. That is where the market risk lies, wealth taxes are often counter productive, leading to an actual reduction in the revenue raised. Gilts would have a problem with that, they would prefer benefit

cuts or an increase in Income Tax to rescue the Budget Deficit.

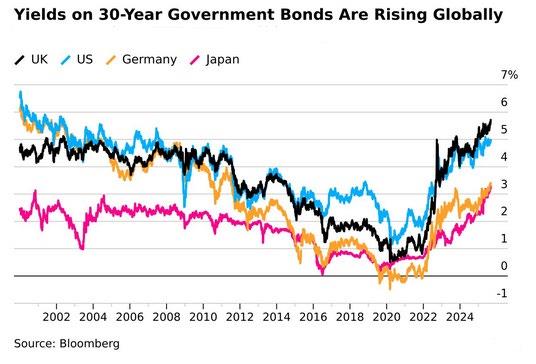

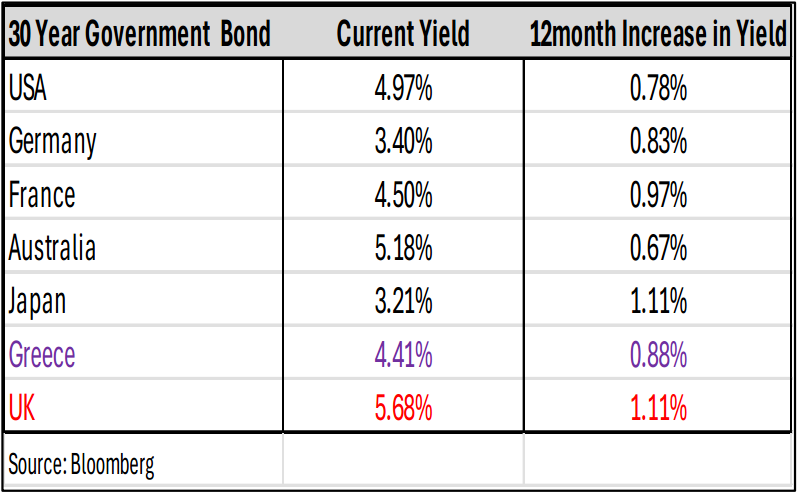

UK Bond Yields

The Gilt market already senses a problem. UK long yields are now 0.7% higher than the USA and higher than even Greece. Whilst bond yields globally have risen to reflect the new post-tariff world, the UK has suffered more than everyone else. It signifies a lack of confidence in the Starmer/Reeves economic leadership. The markets would like the UK Budget Deficit to be reduced and more importantly, seen to be on a persistent downward trend. Doesn’t have to be a massive one off reduction but to be a long term plan that is clearly achievable. Freezing personal allowances would help, but benefit cuts would be perceived to be better by the markets. If you have a massive overdraft, cut your spending first before trying to raise your salary. Markets will find it difficult if a range of wealth taxes are introduced where it isn’t clear just how much revenue will be raised, especially if these taxes harm economic growth. Satisfying both Labour MPs and the markets will be a challenge.

Markets

September is always a difficult month for markets. Traders, investment managers, central bankers and politicians all return to work after the Summer break and this can lead to major trend changes occurring in September and October. Traders in particular like to drag prices down in order to load up on cheap stocks ahead of the run in to year end. What they are all faced with is a complex economic picture. Markets know that the Trump tariffs will be inflationary, they just don’t know by how much and for how long. The US 30 year bond yield is rising to reflect this risk and that is dragging others around the world with it. UK, France and Japan have their own fiscal issues to deal with, but, the main driver in rising global yields are the Trump tariffs. We should start to see this month the exact impact on the US consumer. That is why the US Federal Reserve’s pivot to focusing on a sharp decline in US job growth is so significant. It comes just as inflation is about to jump. The economic data releases from now on will be very closely scrutinised. Firstly, are they believable, particularly given the fiasco over the July employment numbers, but also the inflation data, exactly how much is a one-off tariff related and how much is underlying trend. Markets will be volatile and will have to price accordingly. Nevertheless, the earnings picture remains robust as global businesses recover from the earnings recession of 2022/23. Ultimately, it is corporate profits that counts and the M2 Money Supply figures tell us, they are going higher.